Newsletter Archives

- Newsletter #3 (January 2009)

- Newsletter #2 (November 2008)

- Newsletter #1 (August 2008)

Newsletter #2, November 2008

Dear friends,

We hope all is well, below are four observations worth considering:

Investment Environment:

10-17-08, Warren Buffett: Buy Stocks! Cash Is Trash!

10-29-08, Stephen Swartzman, CEO Blackstone: “This is a wonderful time to invest with great values in every asset class.”

Currency: Dollar Gaining Strength

Some would say that the dollar is now becoming again a safe currency and the US once again a safe haven to invest/park money.

Markets: Equity Fallout in the past 12 months

At the risk of ruining your Saturday morning coffee, our team has pulled together a summary of equity market results from the market peak in October of 2007. While the market results are more dramatic than most anyone would have imagined, the damage underscores the certainty with which market participants have priced in a deep recession.

The Russell 2000 is off by 35% from October 2007. In this period, the S&P 500 lost 41%, the S&P MidCap has given up 38% and Micro Caps are off by 41%!

- The damage is truly broad based - Utilities (the best-performing segment) is off by 20%. Next in line are Industrials (-28%), Healthcare (-30%) and Consumer Staples (-31%).

- Over 75% of the 120 industries are off by 30% or more! See Figure below.

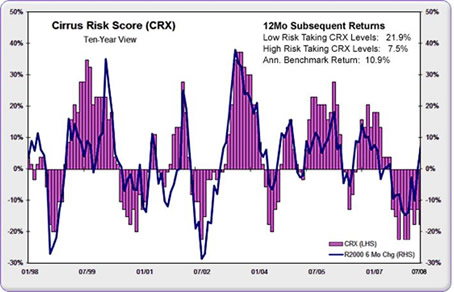

CRX Risk Taking Model points to Higher Equity Returns

Easing LIBOR spreads and aging defensiveness in markets point to a rise in risk taking. The measure of risk taking, Cirrus Risk Score (CRX), has been low for eight months. A resurgence in risk appetite signals higher absolute returns, lower cap and a higher beta bias. Managers with a quality bias are likely to come under pressure; lower market cap offers some protection. Position for broad market, not narrow leadership.

- The market appears to be more valuation sensitive. Quality factors such as low leverage and high ROE appear to be the most consistent themes. The run-up and collapse in Momentum has been sharp. Ironically, the recent snapback in momentum is based more on new leadership in the form of defensive Consumer Staples than the parabolic Energy sector of earlier this year.

The most resilient industries include: Railroads, General Merchandise Stores, Electrical Components and Health Care Distributors.

The US Elections

Now that the election in the USA is completed after a long 21 month campaign and no matter what your political preferences and alignment may be, with President-elect Barack Obama taking office in January 2009 the world will surely see some changes coming and confidence injected into the system. All this will be good for the various markets and will help stabilize the economy both in the US and worldwide. We see this stabilization effect coming quickly after months and years of uncertainty.